Views: 4158

![]()

Journalist

Share this article FET’s price climbed by 12% in the last 24 hours Buying pressure on the token remained high across the board though

Artificial Superintelligence Alliance [FET] has outperformed several cryptos over the last 24 hours with a double-digit price hike on the charts. In fact, its latest price pump pushed the token above its critical resistance. According to AMBCrypto’s analysis, this move could push FET’s price to $3 soon!

FET to $3 next?

At the time of writing, FET was trading at $1.83, having appreciated significantly by over 12% in the last 24 hours alone. Owing to the same, over 97,000 FET addresses are now in profit – Accounting for over 78% of the total number of addresses.

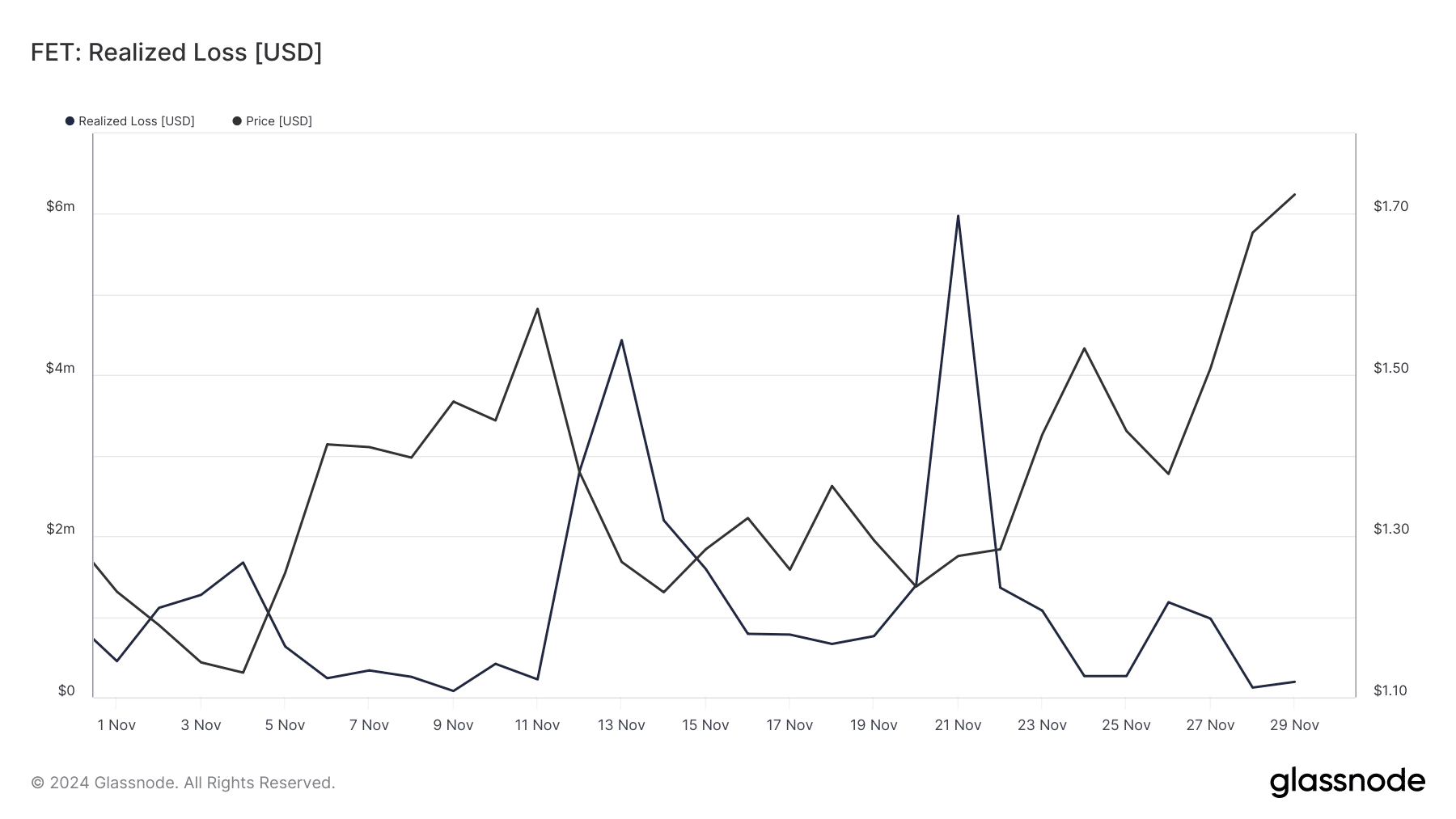

Additionally, the price pump also resulted in a sharp decline in the token’s realized losses. A drop in this metric usually means that the total loss of coins that were moved at a higher price than the current price has fallen.

Source: Glassnode

While that happened, ZAYK Charts pointed out a notable development. As per the analyst’s tweet , FET’s price hike allowed it to go above a resistance level. To be precise, the token managed a breakout from a descending trendline, hinting at a further price hike in the coming days.

If that happens, then investors might soon see the token touching $3 – A target the token hit during March 2024’s bull rally.

Source: X

Is the road ahead clear?

Now, while the breakout did suggest a rally to $3, to double-check, AMBCrypto assessed the token’s on-chain data to find out if there are any hindrances ahead.

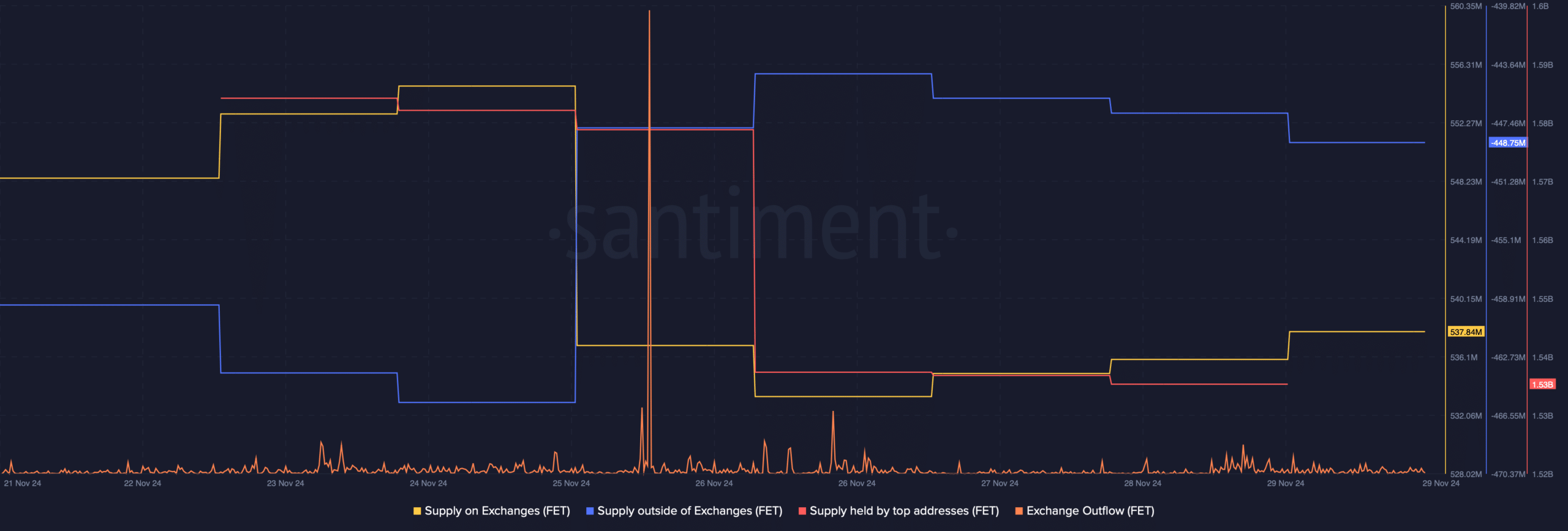

As per our analysis of Santiment’s data, buying pressure has remained high. This was evidenced by the rise in FET’s supply outside of exchanges, while its supply on exchanges dropped. The fact that investors were buying FET was further proven by the spike in its exchange outflows. However, the whales had other plans.

The token’s supply held by top addresses registered a decline, indicating that some big-pocketed players sold their holdings. This can be a profit-taking move, one which often results in price corrections.

Related

Discover more from 25finz, L.L.C

Subscribe to get the latest posts sent to your email.

No comments yet. Be the first to comment!

You must be logged in to post a comment. Log in